Published in The News on May 10, 2023

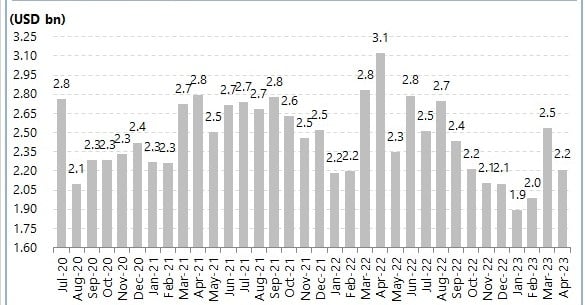

After hitting a seven-month high in March, remittances sent by overseas Pakistanis decreased to $2.21 billion in April — down 29% year-on-year, the State Bank of Pakistan (SBP) shared Wednesday in its monthly bulletin.

Last month’s high remittances were because of Ramadan and Eid ul Fitr as well as the shrinking gap between the rates in the interbank and open markets, which had prompted overseas Pakistanis to increase the use of legal channels to send money back home, analysts had said.

According to the latest data, remittances in April went down 13% compared to the previous month when the figure was recorded at $2.5 billion.

The highest inflows came from Pakistanis residing in Saudi Arabia, who sent back $489.3 million in April. This was followed by the United Arab Emirates at $382.1 million, the United Kingdom at $360.7 million, the United States at $275.8 million, and European Union countries at $257.3 million.

The decline in remittances comes as Pakistan faces a persistent liquidity crunch and an acute balance of payments crisis. The foreign exchange reserves held by the central bank stand at $4.46 billion as of April 28, which is not enough to cover even a month’s imports — a position that has remained the same for months.

Meanwhile, talks between the government and the International Monetary Fund (IMF) for the revival of a stalled loan programme have not met with much success.

A day earlier, Moody’s Investor Service warned that without an IMF programme, Pakistan could default as its financing options beyond June are “uncertain”.

“We consider that Pakistan will meet its external payments for the remainder of this fiscal year ending in June,” sovereign analyst with the ratings company in Singapore Grace Lim said.

“However, Pakistan’s financing options beyond June are highly uncertain. Without an IMF programme, Pakistan could default given its very weak reserves.”