By Shahbaz Rana

Published in The Express Tribune on August 22, 2023

ISLAMABAD: Pakistan got over $5 billion in fresh loans in July, which was the highest amount received in any month, to meet project and foreign exchange reserve requirements, as the interim government sought a review of the annual financing plan in light of the prevailing economic conditions.

According to provisional statistics compiled by the Ministry of Economic Affairs and the State Bank of Pakistan (SBP), there was a massive jump in inflows of foreign loans after Islamabad struck a nine-month deal with the International Monetary Fund (IMF).

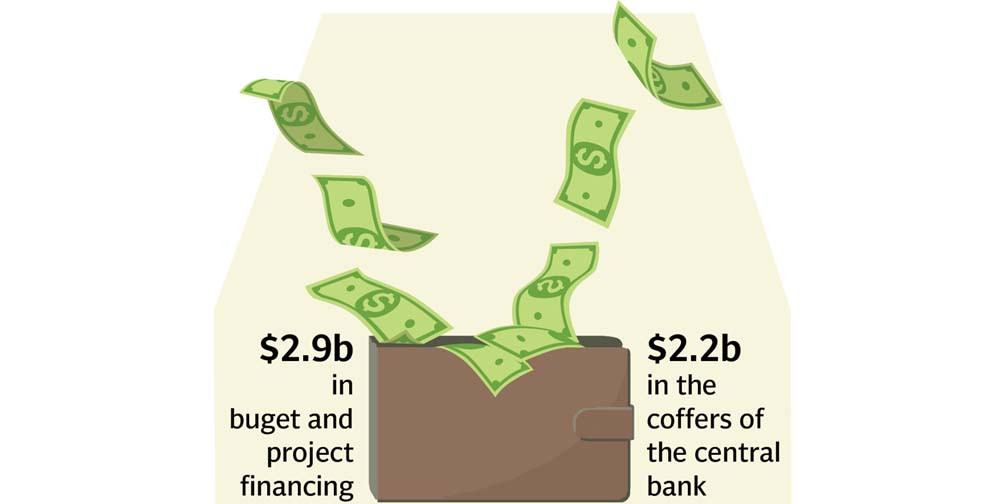

Pakistan received $2.9 billion in budget and project financing and another $2.2 billion came in coffers of the central bank in July, the first month of fiscal year 2023-24.

On the back of these injections, the gross foreign exchange reserves held by the central bank jumped to more than $8 billion.

Out of the total of $5.1 billion, $3 billion was disbursed by Saudi Arabia and the United Arab Emirates (UAE). The IMF disbursed $1.2 billion.

Fresh details showed that Saudi Arabia gave a $2 billion loan for a period of two years at 4% interest rate. The loan will mature in July 2025.

China disbursed $508.4 million for the JF-17 B project funded by China National Aero-technology Import and Export Corporation (CATIC), according to information released by the Ministry of Economic Affairs on Monday.

Disbursements by other foreign creditors were not very high but were in line with the flows usually received in July.

The Asian Development Bank (ADB) disbursed $20 million, the World Bank $82 million, the Islamic Development Bank $67 million and Saudi Arabia $100 million under the oil financing facility.

Pakistan received a $75 million loan against the highly expensive Naya Pakistan Certificates.

The IMF’s recent staff-level report underlined that medium-term risks to Pakistan’s debt “are high” and the risks included uneven programme implementation, political risks and access to adequate multilateral and bilateral financing in view of the high gross financing needs.

According to the IMF report, Pakistan needs $12.3 billion in fresh loans just for the July-December period of current fiscal year to meet the requirements of maturing loans. Overall, for this fiscal year, the IMF has estimated the gross financing needs at $28.3 billion.

“The overall risk of sovereign stress is high, reflecting a high level of vulnerability from elevated debt and gross financing needs and low reserve buffers,” stated the IMF’s staff-level report released this week.

Finance Minister Dr Shamshad Akhtar on Monday received a briefing on the country’s debt situation. She was given an update about the government’s overall external financing requirement.

The minister was given a breakdown of the projected foreign loans that the government was expecting in the current fiscal year and about the debt sustainability situation.

Sources said that the finance minister directed officials to review the plan in light of the prevailing economic conditions, particularly the estimates of loans to be arranged from non-Chinese foreign commercial banks and sovereign bonds.

design: Ibrahim Yahya She inquired whether Pakistan would get $4.5 billion in budgeted non-Chinese commercial loans. The Ministry of Finance appeared positive. The government has also budgeted $1.5 billion in loans by floating bonds.

She was apprised of risks to the country’s debt sustainability, particularly from the unexpected shocks.

The risks to Pakistan’s public debt remain high and any further exchange rate shock would persistently keep debt above the sustainable level of 70% of the nation’s economy in the next three years.

Pakistan’s debt-to-GDP ratio and gross financing needs-to-GDP ratio are currently exceeding sustainable levels estimated at 70% of GDP and 15% of GDP respectively.

If the gross financing needs surpass 15% of GDP, it is considered unsustainable. Sources said that the Ministry of Finance’s projections suggested that the needs would remain above that threshold for at least three years.

Due to any adverse shocks, these two ratios may remain above the sustainable levels until at least 2026, according to the finance ministry.

A recently conducted risk assessment showed that shocks related to real GDP growth, primary balance, real interest rate, exchange rate, and contingent liabilities would lead to an increase in the debt burden, surpassing the 70% threshold and rendering it unsustainable.

Even without any shock scenario, it is projected that the gross financing needs will range from 19.2% to 18.9% of GDP during the next three fiscal years, which still exceeds the sustainable level of 15%.

In its report, the IMF has projected a current account deficit of $6.4 billion for this fiscal year, equivalent to 1.8% of gross domestic product (GDP) and financing needs at 22.2% of GDP.