By Khurram Husain

Published in Dawn on June 14, 2023

WITH dangerously low foreign exchange reserves and a steep debt repayment schedule looming for fiscal year 2024 that begins in July, Pakistan is facing a stark prospect of potential default or even a larger balance of payments crisis in the 12 months ahead.

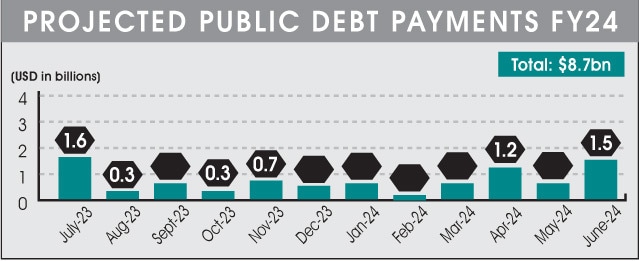

Data obtained unofficially from a senior source privy to the country’s debt repayment schedule shows Pakistan faces $8.7 billion outflows on public debt payments in FY24 (including principal and interest) that are not subject to rollover.

On top of this, there is another $5bn approximately on private debt outflows as per the IMF staff report released in September 2022, bringing the total to $13.7bn in debt-related payments. Repayments on account of publicly guaranteed debt are on top of this.

The monthly schedule of outflows as per this government data is shown in the attached graphic. Assuming zero current account deficit, all rollovers going smoothly, debt payments made on time and no external financing support, the data shows State Bank’s foreign exchange reserves going negative by December of this year.

A large payment of $1.6bn is due in July, including $1bn of a Chinese SAFE deposit that is maturing and has been rolled over smoothly in all years since it was drawn. Government accounting convention requires it be listed as an outflow until a rollover date has been agreed between both parties. Should it be rolled over successfully again this year, July will still see a sizable outflow of $600 million.

June is already seeing hectic activity around debt repayments. In an analyst briefing following Monday’s monetary policy decision, the State Bank governor said $3.6bn was maturing this month, of which $400m has already been paid and another $2.3bn is likely to be rolled over.

“We have concurrence from both sides on this,” he told the attendees, though it seems a date has not yet been agreed because the amount is still being counted as an outflow. That still leaves a $900m further debt service bill in June to be covered from the reserves that are below $4bn already.

Of the total outflows on public debt account scheduled for the next fiscal year, $4.7bn is in July to December. April 2024 sees a large bond maturity when outflows leap to $1.2bn, and June 2024 sees another $1.5bn maturity of several instruments, only some of which are eligible for rollover.

If the government succeeds in the next few days in getting a rollover on the $2.3bn loan from a consortium of Chinese banks that was announced on June 22 last year, the scheduled outflow for June 2024 will rise to $3.8bn since these maturities will then fall due next June.

According to the last IMF staff report, private debt repayments on external account for FY24 are $5bn. These funds are also, under normal circumstances, rolled over fairly easily provided the borrower has been servicing the loan on time. Whether or not they’ll represent a drain on the reserves in the forthcoming year depends on the ability of these borrowers to continue servicing their loans in foreign exchange.

The same report shows Pakistan’s total public debt repayments to be just under $20bn, with another $1.68bn to be repaid to the IMF, and $13bn given as rollover on short-term debt. These numbers suggest outflows on public debt payments should be $8.7bn, consistent with unofficial government figures obtained by Dawn.

But this figure differs greatly from other numbers compiled by sovereign debt advisory firms and private creditors who hold Pakistani bonds. One such data panel, drawn up by a European firm and seen by Dawn, shows public external debt servicing for FY24 to be slightly higher than $14bn.

These creditors and firms triangulate their numbers from various sources, including databases maintained by Bloomberg, the World Bank and the IMF. When Dawn asked one of them for an explanation as to why their estimate for Pakistan’s debt service obligations for FY24 differs so widely from the one provided by the government, they offered various theories but were unable to reconcile the difference mainly because they could not agree on the assumptions that went into deciding which debt obligations will be rolled over and which ones will not.

“We never used this figure,” one individual, who has worked on estimating Pakistan’s debt service obligations, said, referring to the $8.7bn number. The person did not wish to be identified due to the sensitivity of the matter. “Because we never managed to understand what they assume will be rolled over.”

According to these individuals from the private sector, the $13bn assumed to be rolled over in FY24 seems too large. “I understand that this would include $7bn of SAFE and Saudi deposit, maybe $1bn of Islamic Development Bank facility. But I am having a hard time understanding where the other $5bn of rollovers come from,” he continued.

Complicating matters further, budget documents show repayment of foreign and short-term credits as $15.3bn in FY24. Against this figure, they show total external inflows to be $24bn, including $4.5bn in commercial borrowing, $4bn in a new SAFE deposit from China, $6bn deposits from Saudi Arabia and the United Arab Emirates and a $1.5bn international bond. How many of these inflows will actually materialise is another large question mark.

Whichever figure one takes — $8.7bn or $14bn or $15.3 — one thing is clear: there is no clear financing plan to meet these obligations for next year.

The government is projecting a current account deficit of $6bn. Coupled with the debt service payments, each of these figures yields an external financing requirement of either $14.7bn or $20bn or $21.3bn.

The plan chalked out by the government sounds optimistic in the absence of an IMF programme. And Finance Minister Ishaq Dar could have complicated the government’s efforts to secure the critical rollovers looming in June and July this year with his premature talk of a possible “debt restructuring”.

Seen from any angle, FY24 is going to see serious headwinds for the external sector, with ramifications for the exchange rate, inflation, and possibly even the integrity of the energy supply chain should the forex shortages intensify.

The country started FY23 with SBP reserves of $9.7bn. It made debt service payments of $9.7bn from July to April, and secured debt-creating inflows of $7.3bn in the same period, yielding a net drain of $2.4bn on the reserves. Coupled with a current account deficit of $3.3bn, the reserves fell by $5.7bn in this period.

No major covenants have been broken with the country’s external creditors so far. But for the next fiscal year Pakistan is looking at a higher debt service bill, very slim chance of securing further external financing support, and far lower level of reserves than last year.

The possibility of landing up in a situation where the foreign exchange reserves can no longer support even the basic life support systems of the economy is now a clear and present danger. If financing support does not arrive fast, the situation would have lingered too close to the edge for too long for a country of 220 million people.